Turkish. Instruction for uploading faturs

Содержание

- 1 Payer information

- 2 Uploading an invoice to the bank

- 3 List of invoices with upload results

- 4 Typical errors and their correction

- 5 Payer information

- 6 Uploading an invoice to the bank

- 7 List of invoices with upload results

- 8 Typical errors and their correction

- 9 Информация о плательщике

- 10 Выгрузка счета в банк

- 11 Список счетов с результатом выгрузки

- 12 Типовые ошибки и их исправление

Instructions for unloading faturs. Analysis and correction of unloading errors

The invoice is a document confirming payment for the services provided and must be uploaded to the bank. In order to avoid adjustments to the figures generated by the bank, it was decided to unload accounts after final settlements with the guests, that is, after the guests evict.

The payers of the invoices can be the guests themselves or the companies. Depending on the type of payer, invoices are uploaded to the bank with the formation of an e-Fatura or e-Archive:* invoices are uploaded to e-Fatura if the payer of the invoice is registered with the tax administration (Vergi Dairesi) and has a tax number (VKN);* invoices are uploaded to e-Archive if the payer of the invoice is not registered with the tax administration (Vergi Dairesi) and only the Taxpayer Identification Number (TCKN).

The choice of the type of fatura is made in the invoice and is a critical factor, because most unloading errors occur precisely as a result of the wrong choice of the type of fatura.

Payer information

There are different requirements for entering payer tax data, depending on the type of payer. Data about the company is entered in the company card (Accounting / Company, Company Card). Data about the guest—an individual—is entered in the guest questionnaire attached to the guest card.

Below are the details that need to be filled in to correctly upload accounts to the bank.

The payer is registered with the tax administration

Company

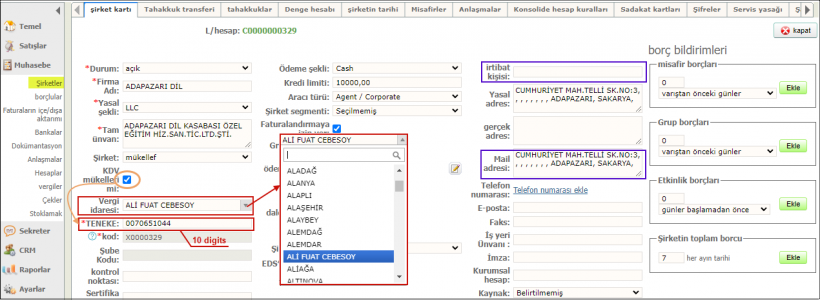

The required fields in the company card are:* Tax administration - selection from a directory similar to the QNB bank directory;* “TIN” (TENEKE) is an identification number consisting of 10 characters.

| To be able to enter a TIN, the “Is a VAT payer” option must be set (KDV mükellefi mi). |

Not required, but recommended fields to be filled in:* “Contact person” with a space between the first and last name;* "Mailing address".

Individual

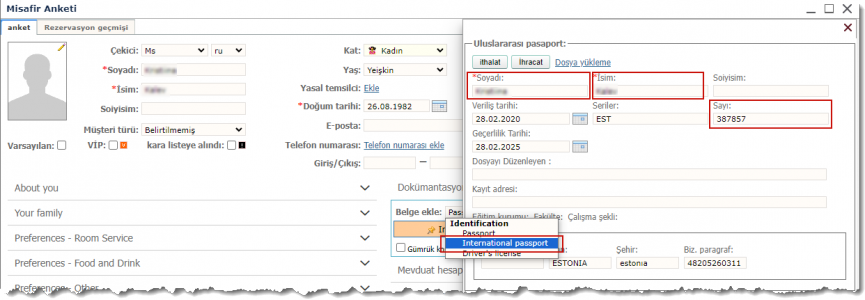

A questionnaire is filled out in the guest card for each person staying in the room. An identification document is entered in the form:* “Passport” or “Driver’s license” for Turkish citizens;* “International passport” - for foreign citizens.

The document must be linked to the current residence - the icon is installed: ![]() .

.

| Be careful! For foreign citizens, be sure to select “International passport” for correct uploading to the police system. |

The following fields must be filled in the identity document:* "Surname";* "Name";* “TIN” (VKN);* tax administration has been selected.The picture shows the document “Passport”.

The payer is not registered with the tax administration

Company

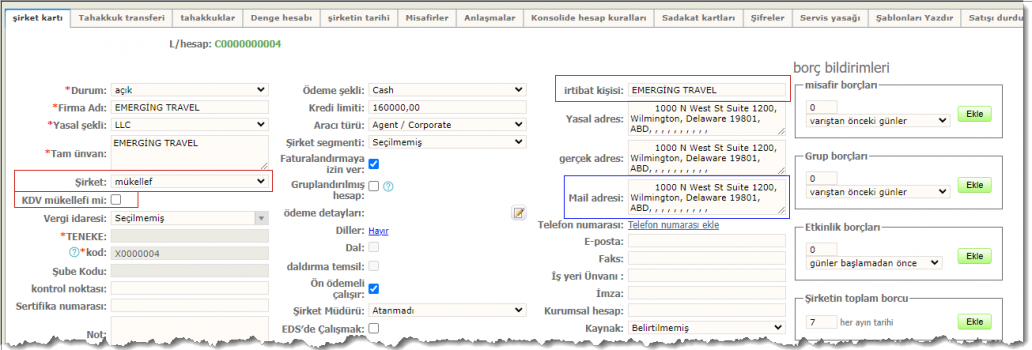

As a rule, companies that are not registered with the tax authority are foreign companies.The required fields in the company card are:* “Company” - Non-resident;

- “Is a VAT payer - the option is off;* “Contact person” with a space between first and last name.

Optional but recommended field:* "Postal address".

| When uploading an invoice with a payer to a non-resident company into QNB, the TIN is automatically filled in with 10 digits “2”: “2222222222”. |

Individual

A questionnaire is filled out in the guest card for each person staying in the room. In the form, you enter an identification document - Passport or Driver's license. The document must be linked to the current residence - the icon is installed: ![]() .

.

The following fields must be filled in the identity document:* "Surname";* "Name";* "Document Number".

The picture shows the document “International passport”.

Uploading an invoice to the bank

To upload an account to the bank, 2 conditions must be comply:# The invoice must be paid and closed.# The guest must be evicted.

As mentioned above, these requirements were introduced in order to prevent adjustments to the faturs uploaded to the bank.

Selecting the type of fatur to be sent and checking the payer’s registration

Working with invoices is an operational activity, so this section will describe operations related only to uploading invoices to the bank.

In order to upload an invoice to the bank, the payer must be a company or a guest, i.e. an object where you can fill out tax details. The payer type is shown in the "Payer" (“ödeyen”) field:* if the code begins with the letter “C”, then the payer is the company (“Company”);* if the code does not contain letters, but only numbers, then the payer is a guest.

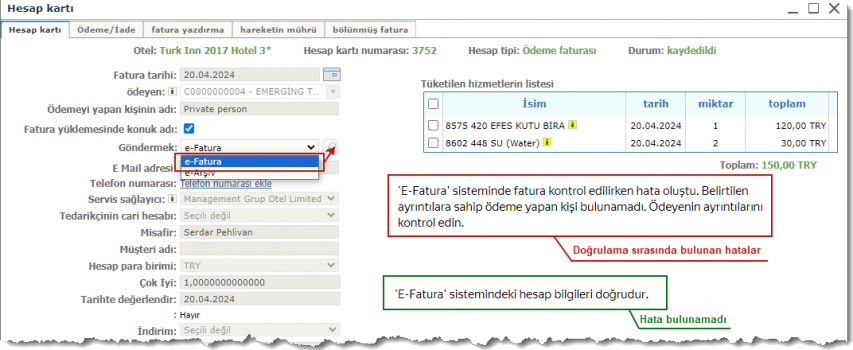

After payment and closing of the invoice, you must select the type of uploaded fatura: e-Fatura or e-Archive. The default value is “e-Invoice” (e-Fatura). For this type of unloading, a check is provided: whether the payer is registered or not with the tax administration. Be sure to check and correct errors in the payer card if any are found.

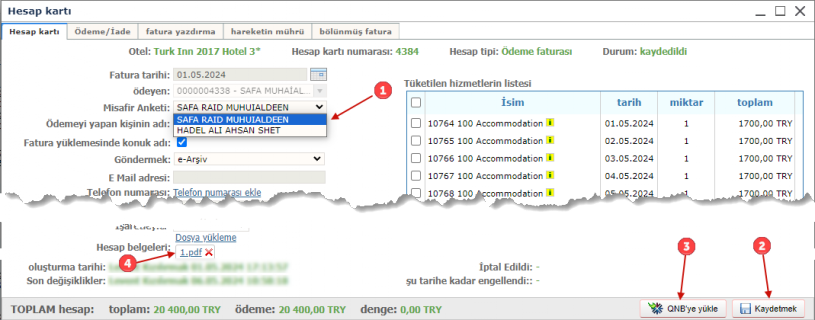

If the payer is a guest, and several guests lived in the room, you can choose in the name of which guest to issue the package. To do this, select the desired entry in the “Guest questionnaire” ("Ödemeyi yapan kişinin adı") list.

After successful upload of the invoice, a form will be generated in the service provider’s personal account at the bank, which will be loaded into the account card in the form of a pdf file (4 in the figure). It can be opened, saved to disk, printed and given to the guest.

{{Вставка

|рис = ![]() |текст = After any change in the invoice card (for example, 1 in the figure), you must first save the changes ([[#Fig.6|2 in the figure] ]), and only then upload the invoice to the bank (3 in the figure).

}}

|текст = After any change in the invoice card (for example, 1 in the figure), you must first save the changes ([[#Fig.6|2 in the figure] ]), and only then upload the invoice to the bank (3 in the figure).

}}

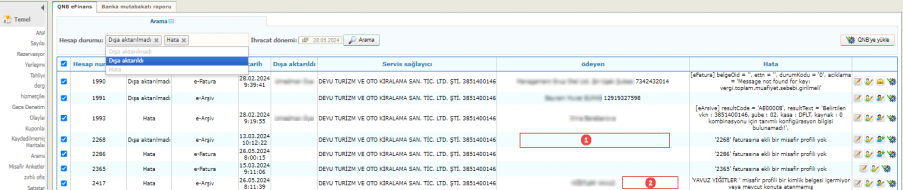

List of invoices with upload results

All information on unloaded, non-unloaded and unloaded with errors invoices can be found on the “QNB eFinance” page, located in “Accounting / Export/Import of invoices” (" Faturaların içe/dışa aktarımı"). At the top of the page there is a block for filtering invoices by unloading status and export period.

By default, filtering of unloaded invoices and invoices with errors for the entire period of work is offered. Click ![]() Search to display posts on the page. If there are no entries on the page with the specified filters, then all accounts were uploaded to the bank successfully.

Search to display posts on the page. If there are no entries on the page with the specified filters, then all accounts were uploaded to the bank successfully.

You can change the filtering. If the “Exported” status is added to the filter, selecting the export period will become available.

Accounts can be selected in the list and uploaded to the bank again by clicking on the ![]() Upload to QNB (QNB′ye yükle) button in the right in the upper corner, however, until the export errors are corrected, it makes no sense to re-upload the documents.

Upload to QNB (QNB′ye yükle) button in the right in the upper corner, however, until the export errors are corrected, it makes no sense to re-upload the documents.

| It is not possible to re-upload a document that has been successfully uploaded to the bank. |

In the right column of the table there are buttons for various functionality for viewing, correcting errors, and uploading to QNB:* ![]() - switch to viewing and editing the invoice card. After a guest evicts, operational work with his card is impossible. However, when moving from this page, some of the fields related to uploading an invoice are available for editing.*

- switch to viewing and editing the invoice card. After a guest evicts, operational work with his card is impossible. However, when moving from this page, some of the fields related to uploading an invoice are available for editing.* ![]() - switch to viewing/editing the guest card;*

- switch to viewing/editing the guest card;* ![]() - switch to viewing/editing the company card;*

- switch to viewing/editing the company card;* ![]() - switch to viewing/editing the guest questionnaire;*

- switch to viewing/editing the guest questionnaire;* ![]() - adding a guest questionnaire;*

- adding a guest questionnaire;* ![]() - uploading an invoice to the bank.

- uploading an invoice to the bank.

Typical errors and their correction

The bank checks the sent invoices and, if incorrect data is detected, returns an error.

The error text is displayed on the “Export/Import of invoices” page.The table below shows the most common upload errors and how to resolve them. After the error is resolved, you must re-upload the invoice.

| Error text | Cause of occurrence | Remedy |

|---|---|---|

| There is no guest profile attached to the account "Account #". Orign text: Hesap numarası' faturasına ekli bir misafir profili yok |

The guest questionnaire has not been entered. Clearly visible in the list of accounts by the empty field (1 on the figure) | Click on the button |

| The guest profile "Guest Name" does not contain any identification document or is not associated with the current place of residence. Orign text: Misafir adı' misafir profili bir kimlik belgesi içermiyor veya mevcut konuta atanmamış |

An identification document has not been added to the guest's questionnaire, or the document has been added but not linked. Clearly visible in the list of accounts for an empty TIN (2 on the figure) | Click on the |

| C<CompanyID> - “Company name” does not contain the first and last name of the contact person separated by a space or is filled in incorrectly Orign text: C<CompanyID> - “Firma Adı”' şirket kartı, iletişim kurulacak kişinin adını ve soyadını boşlukla ayırarak içermiyor veya doğru doldurulmamış |

1. Wrong upload type selected: e-Archive instead of e-Invoice |

1. Click on the |

| [eArsive] resultCode = [eArsive] resultCode = 'AE00084', resultText = 'TIN code. It/His/Her TIN is the registered user of the e-Invoice in the period from “registration date” to -. It is impossible to issue an fatura in an e-Archive!', Orign text: [eArsive] resultCode = 'AE00084', resultText = 'No VKN ' si “ Kayıt Tarihi” ile - tarihleri arası e-Fatura kayıtlı kullanıcısıdır. e-Arşiv faturası kesilemez!', |

Wrong upload type selected: e-Archive instead of e-Invoice | Click on the |

| [eInvoice] documentOid = '6mlvkpfycr1399', ettn = '' , statusCode = 'CODE_2', description = 'tr.com.cs.csap.util.BusinessLogicException: MessageCode: Buyer.is.not.active.on.invoice.date' Orign text: [eFatura] belgeOid = '6mlvkpfycr1399', ettn = '', durumKodu = 'KOD_2', aciklama ='tr.com.cs.csap.util.BusinessLogicException:MessageCode:alici.fatura.tarihinde.aktif.degildir' |

1. Wrong upload type selected: e-Invoice instead of e-Archive |

1. If the payer is a company, then click on the |

| [eArsive] resultCode = 'AE00003', resultText = 'Validation of invoice document failed! Error Details: If the value of the SchemeID attribute of the cbc:ID element is "TIN", the 10-digit Taxpayer Identification Number must be recorded in the cbc:ID element. Orign text: [eArsive] resultCode = 'AE00003', resultText = 'Fatura belgesi validasyon işlemi başarısız! Hata Detayı : cbc:ID elemanının schemeID niteliği değeri 'VKN' olması durumunda cbc:ID elemanına 10 haneli vergi kimlik numarası yazılmalıdır. ', |

Payer: company. TIN is not entered in the company card | Click on the |

| [eArsive] resultCode = 'AE00003', resultText = 'Validation of invoice document failed! Error details: If the value of the SchemeID attribute of the cbc:ID element is "TC ID", the 11-digit Turkish identification number must be recorded in the cbc:ID element. Orign text: [eArsive] resultCode = 'AE00003', resultText = 'Fatura belgesi validasyon işlemi başarısız! Hata Detayı : cbc:ID elemanının schemeID niteliği değeri 'TCKN' olması durumunda cbc:ID elemanına 11 haneli TC kimlik numarası yazılmalıdır. ', |

Плательщик: гость.

1. The TIN is not entered on the identity card or is entered incorrectly |

Click on the |

| [eArsive] resultCode = 'AE00003', resultText = 'Invoice document verification failed! Error details: For VAT with tax code 0015 and tax amount 0, the cbc:TaxExemptionReason element must exist and it must not contain a null value. Orign text: [eArsive] resultCode = 'AE00003', resultText = 'Fatura belgesi validasyon işlemi başarısız! Hata Detayı : Vergi miktarı 0 olan 0015 vergi kodlu KDV için cbc:TaxExemptionReason(vergi istisna muhafiyet sebebi) elemanı bulunmalıdır ve boş değer içermemelidir. ', |

Check invoice. The Invoice balance may be zero. | If there is an error in the invoice, create a correct invoice and upload it to the bank. If the invoice amount should be 0, do not upload the account to the bank |

| [eArsive] resultCode = 'AE00001', resultText = 'An unexpected error has occurred! Error Details: Object Storage Path: W_24:earsiv/temp/gelen/7342432014/24/05/16/be6ed846-c3d2-4284-9d0e-4dbbf4f9bd28/1715833435724.xml не удалось сохранить. Orign text: [eArsive] resultCode = 'AE00001', resultText = 'Beklenmeyen bir hata oluştu! Hata detayı : Object store path: W_24:earsiv/temp/gelen/7342432014/24/05/16/be6ed846-c3d2-4284-9d0e-4dbbf4f9bd28/1715833435724.xml icin kaydetme islemi gerceklestirilemedi.', |

Bank service is unavailable | Try uploading the invoice again after some time. After the connection with the bank is restored, the account will be uploaded |

| [eArsive] resultCode = 'AE00999', resultText = 'Request timeout!!! Orign text: [eArsive] resultCode = 'AE00999', resultText = 'İstek zaman aşımına uğradı!!!', |

Timed out waiting for a response from the bank | Try uploading the invoice again after some time. After the connection with the bank is restored, the account will be uploaded |

| [eArsive] resultCode = 'AE00001', resultText = 'Failed to open Hibernate session for transaction; nested exception: org.hibernate.Exception.GenericJDBCException: Failed to open connection' Orign text: [eArsive] resultCode = 'AE00001', resultText = 'Could not open Hibernate Session for transaction; nested exception is org.hibernate.exception.GenericJDBCException: Could not open connection', |

Bank service is unavailable | Try uploading the invoice again after some time. After the connection with the bank is restored, the account will be uploaded |

|

[eArsive]resultCode = 'AE00040', resultText = 'You can issue an invoice up to 36 days before the invoice date. You cannot issue an invoice for a later date!» |

Uploading invoice is overdue | Request permission from the accounting department to change the invoice date. If the change is agreed upon, contact support |

Instructions for unloading faturs. Analysis and correction of unloading errors

The invoice is a document confirming payment for the services provided and must be uploaded to the bank. In order to avoid adjustments to the figures generated by the bank, it was decided to unload accounts after final settlements with the guests, that is, after the guests evict.

The payers of the invoices can be the guests themselves or the companies. Depending on the type of payer, invoices are uploaded to the bank with the formation of an e-Fatura or e-Archive:* invoices are uploaded to e-Fatura if the payer of the invoice is registered with the tax administration (Vergi Dairesi) and has a tax number (VKN);* invoices are uploaded to e-Archive if the payer of the invoice is not registered with the tax administration (Vergi Dairesi) and only the Taxpayer Identification Number (TCKN).

The choice of the type of fatura is made in the invoice and is a critical factor, because most unloading errors occur precisely as a result of the wrong choice of the type of fatura.

Payer information

There are different requirements for entering payer tax data, depending on the type of payer. Data about the company is entered in the company card (Accounting / Company, Company Card). Data about the guest—an individual—is entered in the guest questionnaire attached to the guest card.

Below are the details that need to be filled in to correctly upload accounts to the bank.

The payer is registered with the tax administration

Company

The required fields in the company card are:* Tax administration - selection from a directory similar to the QNB bank directory;* “TIN” (TENEKE) is an identification number consisting of 10 characters.

| To be able to enter a TIN, the “Is a VAT payer” option must be set (KDV mükellefi mi). |

Not required, but recommended fields to be filled in:* “Contact person” with a space between the first and last name;* "Mailing address".

Individual

A questionnaire is filled out in the guest card for each person staying in the room. An identification document is entered in the form:* “Passport” or “Driver’s license” for Turkish citizens;* “International passport” - for foreign citizens.

The document must be linked to the current residence - the icon is installed: ![]() .

.

| Be careful! For foreign citizens, be sure to select “International passport” for correct uploading to the police system. |

The following fields must be filled in the identity document:* "Surname";* "Name";* “TIN” (VKN);* tax administration has been selected.The picture shows the document “Passport”.

The payer is not registered with the tax administration

Company

As a rule, companies that are not registered with the tax authority are foreign companies.The required fields in the company card are:* “Company” - Non-resident;

- “Is a VAT payer - the option is off;* “Contact person” with a space between first and last name.

Optional but recommended field:* "Postal address".

| When uploading an invoice with a payer to a non-resident company into QNB, the TIN is automatically filled in with 10 digits “2”: “2222222222”. |

Individual

A questionnaire is filled out in the guest card for each person staying in the room. In the form, you enter an identification document - Passport or Driver's license. The document must be linked to the current residence - the icon is installed: ![]() .

.

The following fields must be filled in the identity document:* "Surname";* "Name";* "Document Number".

The picture shows the document “International passport”.

Uploading an invoice to the bank

To upload an account to the bank, 2 conditions must be comply:# The invoice must be paid and closed.# The guest must be evicted.

As mentioned above, these requirements were introduced in order to prevent adjustments to the faturs uploaded to the bank.

Selecting the type of fatur to be sent and checking the payer’s registration

Working with invoices is an operational activity, so this section will describe operations related only to uploading invoices to the bank.

In order to upload an invoice to the bank, the payer must be a company or a guest, i.e. an object where you can fill out tax details. The payer type is shown in the "Payer" (“ödeyen”) field:* if the code begins with the letter “C”, then the payer is the company (“Company”);* if the code does not contain letters, but only numbers, then the payer is a guest.

After payment and closing of the invoice, you must select the type of uploaded fatura: e-Fatura or e-Archive. The default value is “e-Invoice” (e-Fatura). For this type of unloading, a check is provided: whether the payer is registered or not with the tax administration. Be sure to check and correct errors in the payer card if any are found.

If the payer is a guest, and several guests lived in the room, you can choose in the name of which guest to issue the package. To do this, select the desired entry in the “Guest questionnaire” ("Ödemeyi yapan kişinin adı") list.

After successful upload of the invoice, a form will be generated in the service provider’s personal account at the bank, which will be loaded into the account card in the form of a pdf file (4 in the figure). It can be opened, saved to disk, printed and given to the guest.

{{Вставка

|рис = ![]() |текст = After any change in the invoice card (for example, 1 in the figure), you must first save the changes ([[#Fig.6|2 in the figure] ]), and only then upload the invoice to the bank (3 in the figure).

}}

|текст = After any change in the invoice card (for example, 1 in the figure), you must first save the changes ([[#Fig.6|2 in the figure] ]), and only then upload the invoice to the bank (3 in the figure).

}}

List of invoices with upload results

All information on unloaded, non-unloaded and unloaded with errors invoices can be found on the “QNB eFinance” page, located in “Accounting / Export/Import of invoices” (" Faturaların içe/dışa aktarımı"). At the top of the page there is a block for filtering invoices by unloading status and export period.

By default, filtering of unloaded invoices and invoices with errors for the entire period of work is offered. Click ![]() Search to display posts on the page. If there are no entries on the page with the specified filters, then all accounts were uploaded to the bank successfully.

Search to display posts on the page. If there are no entries on the page with the specified filters, then all accounts were uploaded to the bank successfully.

You can change the filtering. If the “Exported” status is added to the filter, selecting the export period will become available.

Accounts can be selected in the list and uploaded to the bank again by clicking on the ![]() Upload to QNB (QNB′ye yükle) button in the right in the upper corner, however, until the export errors are corrected, it makes no sense to re-upload the documents.

Upload to QNB (QNB′ye yükle) button in the right in the upper corner, however, until the export errors are corrected, it makes no sense to re-upload the documents.

| It is not possible to re-upload a document that has been successfully uploaded to the bank. |

In the right column of the table there are buttons for various functionality for viewing, correcting errors, and uploading to QNB:* ![]() - switch to viewing and editing the invoice card. After a guest evicts, operational work with his card is impossible. However, when moving from this page, some of the fields related to uploading an invoice are available for editing.*

- switch to viewing and editing the invoice card. After a guest evicts, operational work with his card is impossible. However, when moving from this page, some of the fields related to uploading an invoice are available for editing.* ![]() - switch to viewing/editing the guest card;*

- switch to viewing/editing the guest card;* ![]() - switch to viewing/editing the company card;*

- switch to viewing/editing the company card;* ![]() - switch to viewing/editing the guest questionnaire;*

- switch to viewing/editing the guest questionnaire;* ![]() - adding a guest questionnaire;*

- adding a guest questionnaire;* ![]() - uploading an invoice to the bank.

- uploading an invoice to the bank.

Typical errors and their correction

The bank checks the sent invoices and, if incorrect data is detected, returns an error.

The error text is displayed on the “Export/Import of invoices” page.The table below shows the most common upload errors and how to resolve them. After the error is resolved, you must re-upload the invoice.

| Error text | Cause of occurrence | Remedy |

|---|---|---|

| There is no guest profile attached to the account "Account #". Orign text: Hesap numarası' faturasına ekli bir misafir profili yok |

The guest questionnaire has not been entered. Clearly visible in the list of accounts by the empty field (1 on the figure) | Click on the button |

| The guest profile "Guest Name" does not contain any identification document or is not associated with the current place of residence. Orign text: Misafir adı' misafir profili bir kimlik belgesi içermiyor veya mevcut konuta atanmamış |

An identification document has not been added to the guest's questionnaire, or the document has been added but not linked. Clearly visible in the list of accounts for an empty TIN (2 on the figure) | Click on the |

| C<CompanyID> - “Company name” does not contain the first and last name of the contact person separated by a space or is filled in incorrectly Orign text: C<CompanyID> - “Firma Adı”' şirket kartı, iletişim kurulacak kişinin adını ve soyadını boşlukla ayırarak içermiyor veya doğru doldurulmamış |

1. Wrong upload type selected: e-Archive instead of e-Invoice |

1. Click on the |

| [eArsive] resultCode = [eArsive] resultCode = 'AE00084', resultText = 'TIN code. It/His/Her TIN is the registered user of the e-Invoice in the period from “registration date” to -. It is impossible to issue an fatura in an e-Archive!', Orign text: [eArsive] resultCode = 'AE00084', resultText = 'No VKN ' si “ Kayıt Tarihi” ile - tarihleri arası e-Fatura kayıtlı kullanıcısıdır. e-Arşiv faturası kesilemez!', |

Wrong upload type selected: e-Archive instead of e-Invoice | Click on the |

| [eInvoice] documentOid = '6mlvkpfycr1399', ettn = '' , statusCode = 'CODE_2', description = 'tr.com.cs.csap.util.BusinessLogicException: MessageCode: Buyer.is.not.active.on.invoice.date' Orign text: [eFatura] belgeOid = '6mlvkpfycr1399', ettn = '', durumKodu = 'KOD_2', aciklama ='tr.com.cs.csap.util.BusinessLogicException:MessageCode:alici.fatura.tarihinde.aktif.degildir' |

1. Wrong upload type selected: e-Invoice instead of e-Archive |

1. If the payer is a company, then click on the |

| [eArsive] resultCode = 'AE00003', resultText = 'Validation of invoice document failed! Error Details: If the value of the SchemeID attribute of the cbc:ID element is "TIN", the 10-digit Taxpayer Identification Number must be recorded in the cbc:ID element. Orign text: [eArsive] resultCode = 'AE00003', resultText = 'Fatura belgesi validasyon işlemi başarısız! Hata Detayı : cbc:ID elemanının schemeID niteliği değeri 'VKN' olması durumunda cbc:ID elemanına 10 haneli vergi kimlik numarası yazılmalıdır. ', |

Payer: company. TIN is not entered in the company card | Click on the |

| [eArsive] resultCode = 'AE00003', resultText = 'Validation of invoice document failed! Error details: If the value of the SchemeID attribute of the cbc:ID element is "TC ID", the 11-digit Turkish identification number must be recorded in the cbc:ID element. Orign text: [eArsive] resultCode = 'AE00003', resultText = 'Fatura belgesi validasyon işlemi başarısız! Hata Detayı : cbc:ID elemanının schemeID niteliği değeri 'TCKN' olması durumunda cbc:ID elemanına 11 haneli TC kimlik numarası yazılmalıdır. ', |

Плательщик: гость.

1. The TIN is not entered on the identity card or is entered incorrectly |

Click on the |

| [eArsive] resultCode = 'AE00003', resultText = 'Invoice document verification failed! Error details: For VAT with tax code 0015 and tax amount 0, the cbc:TaxExemptionReason element must exist and it must not contain a null value. Orign text: [eArsive] resultCode = 'AE00003', resultText = 'Fatura belgesi validasyon işlemi başarısız! Hata Detayı : Vergi miktarı 0 olan 0015 vergi kodlu KDV için cbc:TaxExemptionReason(vergi istisna muhafiyet sebebi) elemanı bulunmalıdır ve boş değer içermemelidir. ', |

Check invoice. The Invoice balance may be zero. | If there is an error in the invoice, create a correct invoice and upload it to the bank. If the invoice amount should be 0, do not upload the account to the bank |

| [eArsive] resultCode = 'AE00001', resultText = 'An unexpected error has occurred! Error Details: Object Storage Path: W_24:earsiv/temp/gelen/7342432014/24/05/16/be6ed846-c3d2-4284-9d0e-4dbbf4f9bd28/1715833435724.xml не удалось сохранить. Orign text: [eArsive] resultCode = 'AE00001', resultText = 'Beklenmeyen bir hata oluştu! Hata detayı : Object store path: W_24:earsiv/temp/gelen/7342432014/24/05/16/be6ed846-c3d2-4284-9d0e-4dbbf4f9bd28/1715833435724.xml icin kaydetme islemi gerceklestirilemedi.', |

Bank service is unavailable | Try uploading the invoice again after some time. After the connection with the bank is restored, the account will be uploaded |

| [eArsive] resultCode = 'AE00999', resultText = 'Request timeout!!! Orign text: [eArsive] resultCode = 'AE00999', resultText = 'İstek zaman aşımına uğradı!!!', |

Timed out waiting for a response from the bank | Try uploading the invoice again after some time. After the connection with the bank is restored, the account will be uploaded |

| [eArsive] resultCode = 'AE00001', resultText = 'Failed to open Hibernate session for transaction; nested exception: org.hibernate.Exception.GenericJDBCException: Failed to open connection' Orign text: [eArsive] resultCode = 'AE00001', resultText = 'Could not open Hibernate Session for transaction; nested exception is org.hibernate.exception.GenericJDBCException: Could not open connection', |

Bank service is unavailable | Try uploading the invoice again after some time. After the connection with the bank is restored, the account will be uploaded |

|

[eArsive]resultCode = 'AE00040', resultText = 'You can issue an invoice up to 36 days before the invoice date. You cannot issue an invoice for a later date!» |

Uploading invoice is overdue | Request permission from the accounting department to change the invoice date. If the change is agreed upon, contact support |

Инструкция по выгрузке фатур. Анализ и исправление ошибок выгрузки

Фатура является документом, подтверждающим оплату предоставленных услуг, и должна быть выгружена в банк. С целью исключения корректировок сформированных в банке фатур, принято решение выгружать счета после окончательных расчетов с гостями, то есть после выселения гостей.

Плательщиками по счетам могут быть сами гости или компании. В зависимости от типа плательщика, счета выгружаются в банк с формированием e-invoice или e-archive:

- в e-invoice выгружаются счета, если плательщик по счету зарегистрирован в налоговой администрации (Vergi Dairesi) и имеет налоговый номер (VKN);

- в e-archive выгружаются счета, если плательщик по счету не зарегистрирован в налоговой администрации (Vergi Dairesi) и только ИНН (TCKN).

Выбор вида фатуры осуществляется в счете и является критичным фактором, т.к. большинство ошибок выгрузки происходит именно в результате неправильного выбора вида фатуры.

Информация о плательщике

К вводу налоговых данных плательщика предъявляются разные требования, в зависимости от типа плательщика. Данные о компании вводятся в карте компании (Бухгалтерия / Компании, Карта компании). Данные о госте — физическом лице вводятся в анкете гостя, прикрепляемой к карте гостя.

Ниже показаны реквизиты, которые нужно заполнить для корректной выгрузки счетов в банк.

Плательщик зарегистрирован в налоговой администрации

Компания

В карте компании обязательными для заполнения являются поля:

- налоговая администрация – выбор из справочника, аналогичного справочнику банка QNB;

- “ИНН” (TENEKE) — идентификационный номер, состоящий из 10 символов.

| Для возможности ввода ИНН должен быть установлен флаг “Является плательщиком НДС” (KDV mükellefi mi). |

Не обязательные, но рекомендуемые для заполнения поля:

- “Контактное лицо” с пробелом между именем и фамилией;

- “Почтовый адрес”.

Физическое лицо

В карте гостя заполняется анкета на каждого проживающего в номере. В анкете вводится документ, удостоверяющий личность:

- “Паспорт” или “Водительское удостоверение” для граждан Турции;

- “Паспорт иностранного гражданина” — для иностранных граждан.

Документ обязательно должен быть привязан к текущему проживанию – установлен значок ![]() .

.

| Будьте внимательны! Для иностранных граждан обязательно выбирайте “Паспорт иностранного гражданина” для корректной выгрузке в полицейскую систему. |

В документе, удостоверяющем личность, должны быть обязательно заполнены поля:

- “Фамилия”;

- “Имя”;

- “ИНН” (VKN);

- выбрана налоговая администрация.

На рисунке изображён документ ”Паспорт”.

Плательщик не зарегистрирован в налоговой администрации

Компания

Как правило, компании, не зарегистрированные в налоговом органе – иностранные компании.

В карте компании обязательными для заполнения являются поля:

- “Компания” — Нерезидент;* “Является плательщиком НДС — флаг снят;

- “Контактное лицо” с пробелом между именем и фамилией.

Не обязательное, но рекомендуемое для заполнения поле:

- “Почтовый адрес”.

| При выгрузке в QNB счета с плательщиком компанией – нерезидентом, ИНН автоматически заполняется 10 цифрами “2”: “2222222222”. |

Физическое лицо

В карте гостя заполняется анкета на каждого проживающего в номере. В анкете вводится документ, удостоверяющий личность — Паспорт или Водительское удостоверение. Документ обязательно должен быть привязан к текущему проживанию – установлен значок ![]() .

.

В документе, удостоверяющем личность, должны быть обязательно заполнены поля:

- "Фамилия";

- "Имя";

- "Номер документа".

На рисунке изображён документ ”Паспорт иностранного гражданина”.

Выгрузка счета в банк

Для выгрузки счета в банк должны быть выполнены 2 условия:

- Счет на оплату должен быть оплачен и закрыт.

- Гость должен быть выселен.

Как было сказано выше, эти требования введены с целью не допустить корректировку выгруженных в банк фатур.

Выбор типа фатуры для отправки и проверка регистрации плательщика

Работа со счетами на оплату относится к оперативной деятельности, поэтому в данном разделе будут описаны операции, относящиеся только к выгрузке счетов в банк.

Для того, чтобы выгрузить счет в банк, плательщиком по ней должна быть компания или гость, т.е. объект, в котором можно заполнить налоговые реквизиты. Тип плательщика показывается в поле “Плательщик”:

- если код начинается с буквы “С”, то плательщик – компания (“Сompany”);

- если в коде нет букв, а только цифры, то плательщик – гость.

После оплаты и закрытия счета необходимо выбрать тип выгружаемой фатуры: e-invoice или e-archive. По умолчанию установлено значение “e-Invoice”. Для данного типа выгрузки предусмотрена проверка: зарегистрирован или нет плательщик в налоговой администрации. Обязательно выполните проверку и исправьте ошибки в карте плательщика, если они обнаружены.

Если плательщик – гость, и в номере проживали несколько гостей, вы можете выбрать, на имя какого гостя оформлять фатуру. Для этого выберите в списке “Анкеты гостей” нужную запись.

После успешной выгрузки счета, в личном кабинете поставщика услуг в банке сформируется фатура, которая загрузится в карту счета в виде pdf-файла (4 на рисунке). Ее можно открыть, сохранить на диск, распечатать и передать гостю.

| После любого изменения в карте счета (например, 1 на рисунке) необходимо сохранить сначала изменения (2 на рисунке), и лишь потом выгрузить счет в банк (3 на рисунке). |

Список счетов с результатом выгрузки

Всю информацию по выгруженным, не выгруженным и выгруженным с ошибками счетам можно найти на странице “QNB eFinance”, расположенной в “Бухгалтерия / Экспорт/Импорт счетов”. В верхней части страницы расположен блок фильтрации счетов по статусу выгрузки и периоду экспорта.

По умолчанию предлагается фильтрация не выгруженных счетов и счетов с ошибками за весь период работы. Нажмите ![]() Поиск для вывода записей на страницу. Если на странице с указанными фильтрами записей нет, значит все счета выгружены в банк успешно.

Поиск для вывода записей на страницу. Если на странице с указанными фильтрами записей нет, значит все счета выгружены в банк успешно.

Вы можете изменить фильтрацию. Если в фильтр добавится статус “Экспортирована”, выбор периода экспорта станет доступен.

Счета можно выделить в списке и выгрузить в банк повторно, щелкнув по кнопке ![]() Выгрузка в QNB в правом верхнем углу, однако до исправления ошибок экспорта повторно выгружать документы смысла не имеет.

Выгрузка в QNB в правом верхнем углу, однако до исправления ошибок экспорта повторно выгружать документы смысла не имеет.

| Повторная выгрузка документа, успешно выгруженного в банк, невозможна. |

В правой колонке таблицы расположены кнопки к различному функционалу для просмотра, исправления ошибок, выгрузке в QNB:

-

— переход к просмотру и редактированию карты счета. После выселения гостя оперативная работа с его картой невозможна. Однако, при переходе с данной страницы часть полей, относящихся к выгрузке счета, для редактирования доступна.

— переход к просмотру и редактированию карты счета. После выселения гостя оперативная работа с его картой невозможна. Однако, при переходе с данной страницы часть полей, относящихся к выгрузке счета, для редактирования доступна.

-

— переход к просмотру/редактированию карты гостя;

— переход к просмотру/редактированию карты гостя;

-

— переход к просмотру/редактированию карты компании;

— переход к просмотру/редактированию карты компании;

-

— переход к просмотру/редактированию анкеты гостя;

— переход к просмотру/редактированию анкеты гостя;

-

— добавление анкеты гостя;

— добавление анкеты гостя;

-

— выгрузка счета в банк.

— выгрузка счета в банк.

Типовые ошибки и их исправление

Банк выполняет проверку отправленных счетов и в случае обнаружения некорректных данных возвращает ошибку. Текст ошибки выводится на странице “Экспорт/Импорт счетов”. В таблице ниже приведены наиболее часто встречающиеся ошибки выгрузки и способы их устранения. После устранения ошибки необходимо повторно выгрузить счет.

| Текст ошибки | Причина возникновения | Способ устранения |

|---|---|---|

| К счету «№ счета» не прикреплен профиль гостя. Оригинальный текст: '№ счета' faturasına ekli bir misafir profili yok |

Не введена анкета гостя. Хорошо видно в списке счетов по незаполненному полю (1 на рисунке) | Щелкнуть по кнопке |

| Профиль гостя «Имя гостя» не содержит документа, удостоверяющего личность, или не привязан к текущему месту жительства. Оригинальный текст: 'Misafir adı' misafir profili bir kimlik belgesi içermiyor veya mevcut konuta atanmamış |

В анкете гостя не добавлен документ, удостоверяющий личность или документ добавлен, но не привязан. Хорошо видно в списке счетов по незаполненному ИНН (2 на рисунке) | Щелкнуть по кнопке |

| «C<CompanyID> - “Название компании” не содержит имя и фамилию контактного лица через пробел или заполнена неправильно' Оригинальный текст: C<CompanyID> - “Firma Adı”' şirket kartı, iletişim kurulacak kişinin adını ve soyadını boşlukla ayırarak içermiyor veya doğru doldurulmamış |

1. Выбран неверный тип выгрузки: e-Archive вместо e-Invoice |

1. Щелкнуть по кнопке |

| [eArsive] resultCode = 'AE00084', resultText = 'Код ИНН. Его ИНН является зарегистрированным пользователем e-Invoice в период с “ дата регистрации” по -. Невозможно выдать фактуру в e-Arhive!', Оригинальный текст: [eArsive] resultCode = 'AE00084', resultText = 'No VKN ' si “ Kayıt Tarihi” ile - tarihleri arası e-Fatura kayıtlı kullanıcısıdır. e-Arşiv faturası kesilemez!', |

Выбран неверный тип выгрузки: e-Archive вместо e-Invoice | Щелкнуть по кнопке |

| [eInvoice] documentOid = '6mlvkpfycr1399', ettn = '', statusCode = 'CODE_2', описание = 'tr.com.cs.csap.util.BusinessLogicException: MessageCode: Buyer.is.not.active.on.invoice.date ' Оригинальный текст: [eFatura] belgeOid = '6mlvkpfycr1399', ettn = '', durumKodu = 'KOD_2', aciklama ='tr.com.cs.csap.util.BusinessLogicException:MessageCode:alici.fatura.tarihinde.aktif.degildir' |

1. Выбран неверный тип выгрузки: e-Invoice вместо e-Archive |

1. Если плательщик компания, то щелкнуть по кнопке |

| [eArsive] resultCode = 'AE00003', resultText = 'Проверка документа счета не удалась! Сведения об ошибке: Если значение атрибута SchemeID элемента cbc:ID равно «TIN», в элементе cbc:ID необходимо записать 10-значный идентификационный номер налогоплательщика. ', Оригинальный текст: [eArsive] resultCode = 'AE00003', resultText = 'Fatura belgesi validasyon işlemi başarısız! Hata Detayı : cbc:ID elemanının schemeID niteliği değeri 'VKN' olması durumunda cbc:ID elemanına 10 haneli vergi kimlik numarası yazılmalıdır. ', |

Плательщик: компания. В карте компании не введен ИНН | Щелкнуть по кнопке |

| [eArsive] resultCode = 'AE00003', resultText = 'Проверка документа счета не удалась! Сведения об ошибке: Если значение атрибута SchemeID элемента cbc:ID равно «TC ID», в элементе cbc:ID необходимо записать 11-значный турецкий идентификационный номер.', Оригинальный текст: [eArsive] resultCode = 'AE00003', resultText = 'Fatura belgesi validasyon işlemi başarısız! Hata Detayı : cbc:ID elemanının schemeID niteliği değeri 'TCKN' olması durumunda cbc:ID elemanına 11 haneli TC kimlik numarası yazılmalıdır. ', |

Плательщик: гость.

1. В удостоверении личности не введен ИНН или введен неверно |

Щелкнуть по кнопке |

| [eArsive] resultCode = 'AE00003', resultText = 'Проверка документа счета не удалась! Сведения об ошибке: для НДС с налоговым кодом 0015 и суммой налога 0 должен существовать элемент cbc:TaxExemptionReason, и он не должен содержать нулевое значение. ', Оригинальный текст: [eArsive] resultCode = 'AE00003', resultText = 'Fatura belgesi validasyon işlemi başarısız! Hata Detayı : Vergi miktarı 0 olan 0015 vergi kodlu KDV için cbc:TaxExemptionReason(vergi istisna muhafiyet sebebi) elemanı bulunmalıdır ve boş değer içermemelidir. ', |

Проверить счет. Возможно, сумма по счету равна нулю | Если ошибка в счете, сформировать корректный счет и выгрузить его в банк. Если сумма по счету должна быть равна 0, не выгружать счет в банк |

| [eArsive] resultCode = 'AE00001', resultText = 'Произошла непредвиденная ошибка! Подробности об ошибке: Путь к хранилищу объектов: W_24:earsiv/temp/gelen/7342432014/24/05/16/be6ed846-c3d2-4284-9d0e-4dbbf4f9bd28/1715833435724.xml не удалось сохранить.', Оригинальный текст: [eArsive] resultCode = 'AE00001', resultText = 'Beklenmeyen bir hata oluştu! Hata detayı : Object store path: W_24:earsiv/temp/gelen/7342432014/24/05/16/be6ed846-c3d2-4284-9d0e-4dbbf4f9bd28/1715833435724.xml icin kaydetme islemi gerceklestirilemedi.', |

Сервис банка недоступен | Повторить попытку выгрузки счета через какое-то время. После восстановления связи с банком счет выгрузится |

| [eArsive] resultCode = 'AE00999', resultText = 'Тайм-аут запроса!!!', Оригинальный текст: [eArsive] resultCode = 'AE00999', resultText = 'İstek zaman aşımına uğradı!!!', |

Истекло время ожидания ответа от банка | Повторить попытку выгрузки счета через какое-то время. После восстановления связи с банком счет выгрузится |

| [eArsive] resultCode = 'AE00001', resultText = 'Не удалось открыть сеанс Hibernate для транзакции; вложенное исключение: org.hibernate.Exception.GenericJDBCException: не удалось открыть соединение', Оригинальный текст: [eArsive] resultCode = 'AE00001', resultText = 'Could not open Hibernate Session for transaction; nested exception is org.hibernate.exception.GenericJDBCException: Could not open connection', |

Сервис банка недоступен | Повторить попытку выгрузки счета через какое-то время. После восстановления связи с банком счет выгрузится |

|

[eArsive]resultCode = 'AE00040', resultText = 'Вы можете выставить счет за 36 дней до даты его создания. Вы не можете выставить счет на более позднюю дату!» |

Выгрузка счета просрочена | Запросить в бухгалтерии разрешение на изменение даты счета. Если изменение будет согласовано, обратиться в службу поддержки |